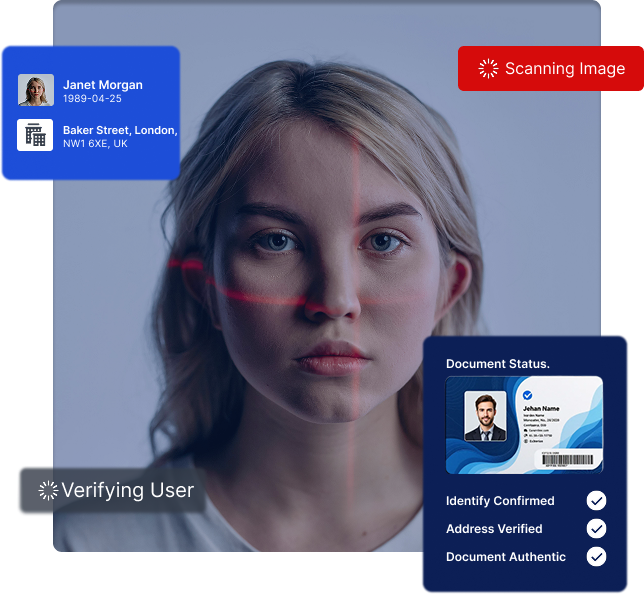

Verify Customers. Authenticate Payments. Prevent Fraud.

A single, smart platform for secure onboarding, seamless authentication, and fraud-proof payments — built for speed, compliance, and trust.

About VerifiEdge

Trust Starts Here. Built for Digital Platforms.

VerifiEdge is a secure, modular platform for real-time identity verification, payment authentication, and compliance automation.

When it comes to onboarding new users or authorising transactions, we help digital-first businesses verify with speed, scale, and certainty — while staying compliant across global regulations.

Learn More About UsWhat We Offer

What We Serve

Built for High-Risk, High-Growth Businesses

VerifiEdge is designed for businesses that require fast, secure, and regulation-ready onboarding — including:

What We Serve

Verify. Authenticate. Transact — with Confidence.

Frequently Asked Questions.

Why Choose VerifiEdge?

Verification, Simplified.

- Real-Time Results.

- Full Compliance.

- Scalable API Infrastructure.

Instant User & Payment Verification

Verify IDs, screen for risks, and authenticate transactions within seconds — all from a single platform.

Fast API Integration & Support

Plug and play into your existing workflows. Our developer-first docs and responsive support make scaling effortless.

Built-in AML & KYC Tools

Screen users against global watchlists, flag suspicious activity, and maintain compliance from day one.

Fraud Prevention by Design

Prevent identity theft, fake accounts, and payment fraud with multilayered verification protocols.

Global Reach, Local Precision

Onboard users from multiple geographies with country-specific checks and global compliance coverage.

Ready to Verify with an Edge?

Start building trust, preventing fraud, and staying compliant — with a platform built for modern digital businesses.

Request a Demo